Credit Card

Premier Bankcard® Card: For bad score

Take your credit score to the next level with Premier Credit Card from First Premier Bank. Enjoy a manageable credit limit, credit score tracking, and fraud protection to help you build a positive credit history.

Advertisement

Premier Bankcard® Card: credit card available even for bad score

Consider the PREMIER Bankcard® Credit Card if you require a credit card but don’t have a good credit score. This card offers credit limits from $200 to $700 without requiring a security deposit.

Acquiring a credit card with a less-than-ideal credit score can be a difficult task, as some issuers demand a good credit score and a minimum income that may not be feasible for many individuals.

Therefore, it is worthwhile to contemplate whether applying for this card is a viable option.

In this review, you will find out the expenses involved in obtaining this card and its potential advantages. If you are contemplating whether or not to apply for it, reading this article will provide you with clarity.

What is necessary to get this card?

Very poor/fair

$45 – $125 + monthly fees

19.9% – 36% APR

Not available

Not available

Is the PREMIER Bankcard® Credit Card a legitimate choice for those looking to rebuild their credit score?

Many credit cards claim to offer an unsecured credit line to individuals with low scores, but this review highlights the drawbacks of this particular card.

Regrettably, this card is not a favorable option due to the numerous fees associated with it. It may lead one to ponder whether a secured credit card would have been a better choice.

Unlike the fees, the security deposit is refundable. Additionally, with a 36% APR, carrying a balance can be a costly mistake.

Despite this, some individuals may still consider this card. However, it is essential to exercise caution and perform the necessary calculations.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Would it be recommended to apply for a PREMIER Bankcard® Credit Card?

The decision to apply for a new credit card is a highly personal one, and only you can determine the best course of action for your situation.

It is crucial to have a thorough understanding of your options to make an informed decision.

To determine whether this card is suitable for you, consider reviewing its advantages and disadvantages.

Pros

- Ability to obtain approval despite having a poor credit score.

- Does not necessitate a security deposit.

- Credit limit can range from $200 to $700, depending on your creditworthiness.

- This card may also be used to improve your credit score.

Cons

- APR that surpasses many loans and other credit cards.

- This card imposes numerous fees, such as annual, monthly, and program fees.

- Depending on the offer, you may end up paying hundreds of dollars in fees without any rewards program or sign-up bonus, resulting in a significant expense with no corresponding benefits.

How to apply for the PREMIER Bankcard® Credit Card?

The PREMIER Bankcard® Credit Card is designed for individuals with poor credit who desire a credit card. You may apply with any credit score, or even with no credit history.

However, it is worth noting that secured credit cards are also accessible to individuals with any credit score.

If you are interested in applying for a PREMIER Bankcard® Credit Card despite the downsides, you may do so online.

Online

To apply for the PREMIER Bankcard® Card, visit the First Premier Bank website and access information about the credit card. Click on the “apply now” button to initiate the application process, which will redirect you to a form.

Ensure that you complete the form accurately and promptly, as it requests basic personal details such as your full name, date of birth, full address, and Social Security Number.

Additionally, you must provide information on your employment status and income, including your employer’s phone number and length of time in the job. Before submitting the form, carefully read the terms and conditions and accept them if they are agreeable to you.

Upon submission, you will receive an email offer detailing the fees and interest rates you qualify for.

Using the app

Upon approval for the PREMIER Bankcard® card, you may download the app to manage your account easily. To obtain your card, apply via the First Premier website.

What about a similar card?

If you are uncertain about the PREMIER Bankcard®, we recommend considering an alternative option that is suitable for individuals with limited or poor credit history. This alternative card does not require a credit check, and you can set your credit limit as per your convenience.

Moreover, it offers perks such as fraud protection and online account management. Explore this option to determine if it aligns with your needs.

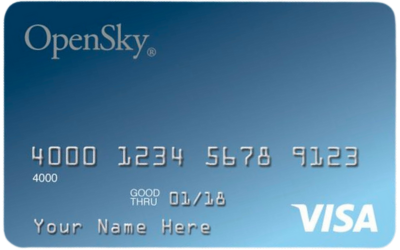

See how to apply for the OpenSky Secured Visa Card

Ideal for individuals seeking to establish or enhance credit, with no bank account or credit check required.

Trending Topics

LendingPoint Personal Loan Review: Flexibility for your finances!

Explore LendingPoint's flexible personal loan options: loan amounts from $2,000 to $36,500. Discover if it's the right fit for your needs.

Keep Reading

Happy Money Personal Loan Review: From Stress to Success!

Discover the power of Happy Money personal loans in shaping a brighter financial future. Explore their benefits and learn how to apply!

Keep ReadingYou may also like

SoFi Personal Loan Review: Low rates, big impact!

Considering a personal loan? Dive into our SoFi review to uncover its features, eligibility requirements, and pros and cons!

Keep Reading

Capital One Walmart Rewards® Card: Cashback

Maximize your Walmart purchases with the Capital One Walmart Rewards® Card. Generous cashback, competitive APR, and no annual fee

Keep Reading