Credit Card

OpenSky Secured Visa Credit Card: With no credit check

OpenSky Secured Visa card: ideal for individuals seeking to establish or enhance credit, with no bank account or credit check required.

Advertisement

OpenSky Secured Visa Credit Card: A secure and straightforward approach to establishing credit!

No bank account or poor credit score can leave you feeling out of options for acquiring credit. However, there is an alternative worth exploring: The OpenSky Secured Visa Credit Card!

With no credit check or checking account requirement, the OpenSky Secured Card is a potent tool for mending impaired credit.

Read on to learn how this product could work for you.

Bad credit

$35

21.89% (variable APR) for Purchases and Cash Advances

None

None

OpenSky Secured Visa credit card: Key Features

To apply for the OpenSky Secured Visa card, you need to make a security deposit, which will become your credit limit.

The card has a 21.89% (variable) APR, a $35 annual fee, and provides free access to your credit score. It can help rebuild your credit by reporting your payment history to all three major credit bureaus.

Despite its benefits, the OpenSky Secured Visa credit card has some limitations. It doesn’t offer any rewards for purchases, and late payments can result in a fee of up to $38.

While the OpenSky Secured Visa card is accessible to all, certain requirements must be met, including having a Social Security Number, being a U.S. citizen or resident, and paying a security deposit.

The deposit will be refunded upon account closure with no outstanding balance.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Should you consider getting an OpenSky Secured Visa credit card?

The OpenSky Secured Visa card is a solid choice for credit repair. With a low annual fee and free credit score access, this card can help improve your credit rating by reporting payment history to all three credit bureaus.

OpenSky offers an instant response without a credit check and the opportunity for an increased credit line after 6 months without an extra deposit. Additionally, customers can choose a due date that aligns with their payroll.

The OpenSky Secured Visa card has some drawbacks to consider. It doesn’t offer rewards, and there’s a $35 annual fee. Additionally, a security deposit is required when applying for the card.

How to apply for the OpenSky Secured Visa credit card?

To improve your financial future, consider starting with the OpenSky Secured Visa card. Continue reading for information on the application process.

Apply online

Applying for the OpenSky Secured Visa card online is simple. Visit their website and click “Apply Now,” providing personal information like your name, address, and Social Security number, along with employment and income details.

OpenSky will review your credit history to determine eligibility, and if approved, a security deposit will be required to obtain the card.

After approval, your new OpenSky Secured Visa card will be mailed to you and ready for immediate use. As a secured card, it’s best to limit usage to emergencies or occasional purchases.

Responsibly using this card can help rebuild your credit history and improve your score.

Apply using the app

OpenSky offers a mobile app for account management, allowing customers to view recent transactions, make payments, and check their next payment date and minimum payment due.

Card activation is available on their website, but the application process is not available through the app.

Comparing OpenSky Secured Visa credit card to Assent Platinum Secured credit card

Not sure if the OpenSky Secured Visa card is the right choice? Consider the Assent Platinum Secured card with its low ongoing APR rate as an excellent alternative for rebuilding your credit history.

Compare the two cards below and use the provided link to apply for the Assent credit card.

OpenSky Secured Visa credit card

No credit score needed, $35 annual fee, 21.89% regular APR (variable) for purchases and cash advances, no welcome bonus, no rewards.

Assent Platinum Secured credit card

Bad to fair credit score, $49 annual fee, 12.99% variable regular APR, no welcome bonus, no rewards.

Learn how to apply for the Assent Platinum Secured

Discover how to apply for Assent Platinum Secured – a credit card that requires no credit history and aids in increasing your credit score!

Trending Topics

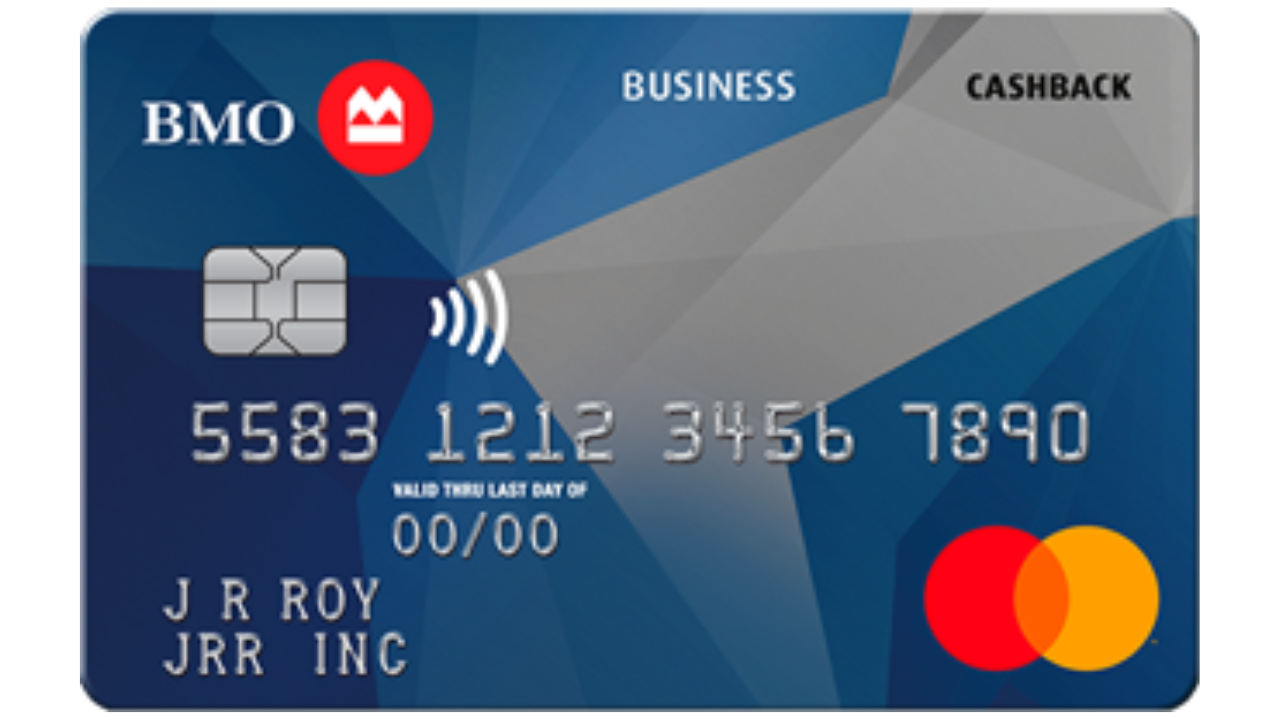

BMO CashBack Business Mastercard: CashBack

Discover the BMO CashBack Business Mastercard and maximize your business rewards with no annual fee. Learn how to apply now!

Keep Reading

Oportun Personal Loan Insights: Accessible Loans!

Fast approval and flexible terms make Oportun personal loan stand out. Read our review to learn about the pros and cons of Oportun loans.

Keep ReadingYou may also like

U.S. Bank Altitude® Go Secured Visa® Card Review: Go further!

A tool like the U.S. Bank Altitude® Go Secured Visa® Card will surprise you with its benefits that go beyond the obvious

Keep Reading

Applied Bank® Gold Preferred® Secured Visa® Credit Card: Helps improve your credit score

Keep Reading

SoFi Personal Loan Review: Low rates, big impact!

Considering a personal loan? Dive into our SoFi review to uncover its features, eligibility requirements, and pros and cons!

Keep Reading