Credit Card

Upgrade Credit Card: Generous credit limit

Discover the exclusive offer of the Upgrade Card that allows you to make significant purchases without any concerns about your credit score or card balance. Continue reading to learn more about this incredible opportunity.

Advertisement

The Upgrade Credit Card provides a generous credit limit along with exceptional payment terms

If you’re tired of paying exorbitant interest rates on your credit card balance, consider the Upgrade Credit Card as a viable option.

This card guarantees payment predictability and allows you to save a significant amount of money through fixed-rate installment payments.

For those with poor or fair credit scores, the credit card under consideration comes with a $0 annual fee and a regular APR ranging from 8.99% to 29.99%.

While there is no welcome bonus offered with the credit card, opening an Upgrade checking account and utilizing its debit card will result in a bonus.

Additionally, it’s important to note that the Upgrade credit card for improving credit does not have any rewards program.

Poor/Fair

$0 annual fee

8.99% to 29.99%

No welcome bonus on obtaining the card, but a bonus is available for opening an Upgrade checking account and using its debit card.

The Upgrade card for credit improvement does not offer any rewards program.

This card is specifically designed for individuals who aim to establish a good credit score. It allows you to make purchases of any size, and the fixed-rate payment feature makes it easier to make timely payments.

To discover more about the benefits of Upgrade and how it can help you build credit, continue reading this review.

How does the Upgrade Credit Card operate?

Credit card fees and interest rates can be challenging for individuals with poor credit scores.

However, this credit-building card offers a solution. It’s simple to obtain like a regular credit card, but operates similar to a personal loan.

This implies that any unpaid balance will be divided into fixed monthly payments.

Get a fantastic credit line and Visa Signature with unique shopping and travel benefits, all with no annual fee. This card is perfect for travel, with no foreign transaction fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Is getting an Upgrade card worth it?

Applying for an Upgrade credit card and using it responsibly can assist in establishing an outstanding credit score. Let’s explore some of its advantages and disadvantages:

Pros

- Accessible with any credit score.

- Provides fraud protection to prevent unauthorized charges.

- Only charges a fixed rate in your monthly installments, not the full balance.

- Includes Visa Signature benefits.

- No annual or late fees.

Cons

- No rewards or welcome bonus.

- The APR may be high depending on your credit score at the time of application, despite the predictability of fixed-rate monthly payments.

Credit scores required

This card is suitable for those who have no credit score or need to improve it, so there is no need to worry about your credit score.

How to apply for the Upgrade card?

It’s uncommon for a credit card tailored for individuals with low credit scores to provide rewards or bonuses upon application.

By obtaining a Visa Signature, your card will be widely accepted, and you’ll enjoy a range of benefits. This credit card is suitable for everyday use as well as larger purchases. Continue reading for information on how to apply.

Apply online

If you’re striving to improve your credit score, you’ll want to avoid damaging it with hard inquiries. Upgrade provides a solution to this by allowing you to pre-qualify and check your offer without any impact on your credit report.

To pre-qualify and check your offer, simply navigate to Upgrade’s website and find the credit card section. From there, click the “get started” button for your preferred card.

If you’re focused on building your credit, opt for Upgrade’s card without rewards.

The application process is straightforward and only requires filling out a simple form with basic information such as your full name, address, annual income, and its source.

To submit the form, create an account using your email and password.

Before submitting your form, make sure to review Upgrade’s terms and conditions, privacy policy, agreements, and other essential information located above the submission button.

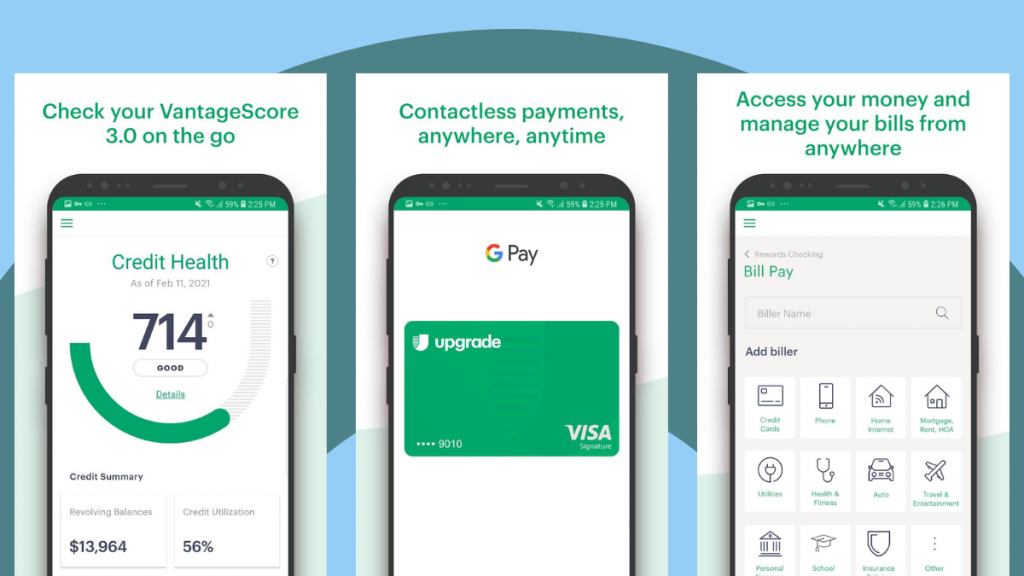

Apply using the app

After obtaining the card by applying through the website, you can download the Upgrade mobile app to manage your monthly payments, review your recent purchases, make payments, and monitor your credit score progress.

Upgrade offers two types of cards: the Upgrade card and the Upgrade card with Cash Rewards.

Upgrade provides a superior credit card option that comes with cash back rewards and the same payment benefits as the Upgrade credit card. You can apply for this card with benefits as soon as you improve your credit score.

Upgrade Card

- Credit Score Range: Poor/Fair;

- Annual Fee: $0;

- Regular APR Range: 8.99% to 29.99%, depending on your creditworthiness;

- Welcome Bonus: N/A;

- Rewards: None offered.

Upgrade Card with Cash Rewards

- Credit Score Range: Average/Good;

- Annual Fee: $0;

- Regular APR Range: 8.99% to 29.99%;

- Welcome Bonus: None offered to new cardholders;

- Rewards: Earn 1.5% cash back on every payment towards your card bill.

Apply for the Upgrade Triple Cash Rewards Visa®!

Learn how to apply for the Upgrade Triple Cash Rewards Visa® in this article and enjoy its benefits!

Trending Topics

Upstart Personal Loan Review: Beyond Credit Scores

Upstart personal loans offers a lifeline for those overlooked by traditional lenders. Learn how their inclusive criteria can benefit you.

Keep ReadingYou may also like

MoneyKey Personal Loans Review: Unlock fast cash!

Need funds fast? MoneyKey Personal Loans provides flexible, quick, and secure options. Dive into our review to learn more and apply today.

Keep Reading

Wells Fargo Reflect® Card: Low APR credit card

The Wells Fargo Reflect® Card is a great choice for those looking for a long period of 0% APR. Check the full review and see how it works!

Keep Reading