Discover a card that offers a low APR and an opportunity to establish your credit.

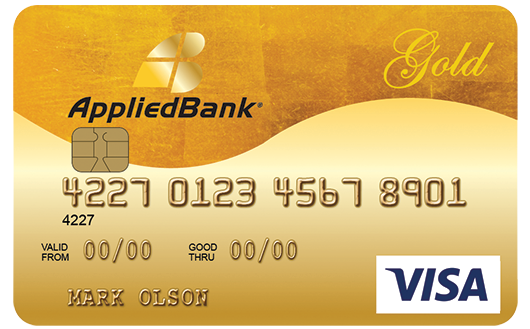

The Applied Bank® Gold Preferred® Secured Visa® is the card that assists you in restoring your credit!

Advertisement

Are you facing difficulty in securing a credit card due to a low credit score? Have you been relying on your debit card despite wanting to establish your credit history? If your answer is yes, then the Applied Bank® Gold Preferred® Secured Visa® Card could be an ideal choice for you. This card is tailored for individuals striving to improve their credit score!

Are you facing difficulty in securing a credit card due to a low credit score? Have you been relying on your debit card despite wanting to establish your credit history? If your answer is yes, then the Applied Bank® Gold Preferred® Secured Visa® Card could be an ideal choice for you. This card is tailored for individuals striving to improve their credit score!

You will remain in the same website

Here are some advantages of the Applied Bank® Gold Preferred® Secured Visa® card!

You will remain in the same website

Whether you’re new to credit or looking to improve your score, this card might just be the key to unlocking your financial goals.

Let’s take a closer look at the pros and cons to see if it’s the right fit for you:

Pros:

- Credit Building Opportunity: Secured credit cards like the Applied Bank® Gold Preferred® offer individuals with limited or poor credit histories an opportunity to build or rebuild their credit. Responsible use of this card, such as making on-time payments and keeping credit utilization low, can help improve credit scores over time.

- No Credit Check Required: Since secured credit cards require a security deposit that serves as collateral, approval is typically easier to obtain compared to traditional unsecured credit cards. As a result, individuals with less-than-perfect credit or no credit history may qualify for this card.

- Reports to Major Credit Bureaus: The Applied Bank® Gold Preferred® Secured Visa® Card reports cardholder activity to the major credit bureaus (Experian, TransUnion, and Equifax). This means that responsible use of the card can positively impact credit scores by demonstrating a history of on-time payments and responsible credit management.

- Flexible Credit Limit: The credit limit on a secured credit card is typically equal to the amount of the security deposit. With the Applied Bank® Gold Preferred® Secured Visa® Card, cardholders have the flexibility to choose a security deposit amount that fits their budget, which in turn determines their credit limit.

Cons:

- Security Deposit Required: To open an account with the Applied Bank® Gold Preferred® Secured Visa® Card, cardholders are required to provide a security deposit. While this deposit serves as collateral and is refundable upon account closure, it may be an upfront cost that some individuals may find prohibitive.

- Annual Fee: Secured credit cards often come with annual fees, and the Applied Bank® Gold Preferred® Secured Visa® Card is no exception. While the fee may be relatively low compared to other secured cards, it’s important for cardholders to factor this cost into their budget when considering the card’s overall value.

- Limited Rewards and Benefits: Unlike some traditional credit cards, secured credit cards typically offer limited rewards and benefits. The Applied Bank® Gold Preferred® Secured Visa® Card may not offer perks such as cashback rewards, travel insurance, or purchase protection that are common with unsecured cards.

- Potential for Account Closure: If cardholders fail to make timely payments or default on their account, the issuer has the right to close the account and apply the security deposit toward the outstanding balance. This can negatively impact the cardholder’s credit score and financial standing.

Overall, the Applied Bank® Gold Preferred® Secured Visa® Card can be a useful tool for credit building. You should carefully weigh the pros and cons to determine if it aligns with your financial goals and needs.

The Applied Bank® Gold Preferred® Secured Visa® Card offers typical credit-building benefits, which many other cards also provide. However, unlike many credit-building cards that come with high APRs, this card has a remarkably low fixed APR of 9.99%.

Absolutely! Rest assured that by using the Applied Bank® Gold Preferred® Secured Visa® Card, you can securely save money and enhance your credit score with the added benefit of a low fixed APR rate.

The Applied Bank® Gold Preferred® Secured Visa® Card transmits its customers’ account details to all three major credit bureaus, Equifax, Experian, and TransUnion, on the final day of every month (the closing statement date). Therefore, by making timely payments and maintaining a low credit utilization rate, you can increase your credit score with confidence.

Would you like to learn how to apply for the Applied Bank® Gold Preferred® Secured Visa®? So check the following post and you’ll find all the information you need!

Apply Applied Bank® Gold Preferred® Secured Visa®

Learn how to apply for the Applied Bank® Gold Preferred® Secured Visa® Card, including requirements.

If the Applied Bank® Gold Preferred® Secured Visa® Card doesn’t meet your needs, you can consider the OpenSky Secured Visa Card, which accepts all credit scores and helps build credit.

A secured credit card is a smart way to rebuild credit. You’ll be able to enjoy lower APR rates and have more control over your finances.

Read on to discover more about this card and how to apply.

Application for the OpenSky Secured Visa Card

Establish or rebuild your credit with the OpenSky Secured Visa card. Apply now and don't let bad credit hold you back from getting what you need.

Trending Topics

Are Credit Cards a Good Financial Tool for Me? When Should I Use One?

Are credit cards good for you? This article breaks down how they work, the benefits they offer, and when it’s smart (or not) to use one.

Keep Reading

Premier Bankcard® Card: For bad score

Looking for a credit card to help you build your credit score? Discover the benefits of Premier Bankcard. Take control of your credit!

Keep ReadingYou may also like

Prosper Personal Loans review: Borrow up to $50,000

Prosper Personal Loans Review: Peer-to-peer lending for competitive rates? Explore pros, cons, & if it's right for you.

Keep Reading

Chase Freedom Unlimited®: Cash back with a great welcome bonus

Maximize your rewards with the Chase Freedom Unlimited Credit Card: 0% introductory APR, $0 annual fee, and generous cashback.

Keep Reading

OneMain Financial Personal Loans Review: Same-Day Funding Power

OneMain Financial: Fast & flexible personal loan options for various needs. Read our review to unlock your financial potential!

Keep Reading