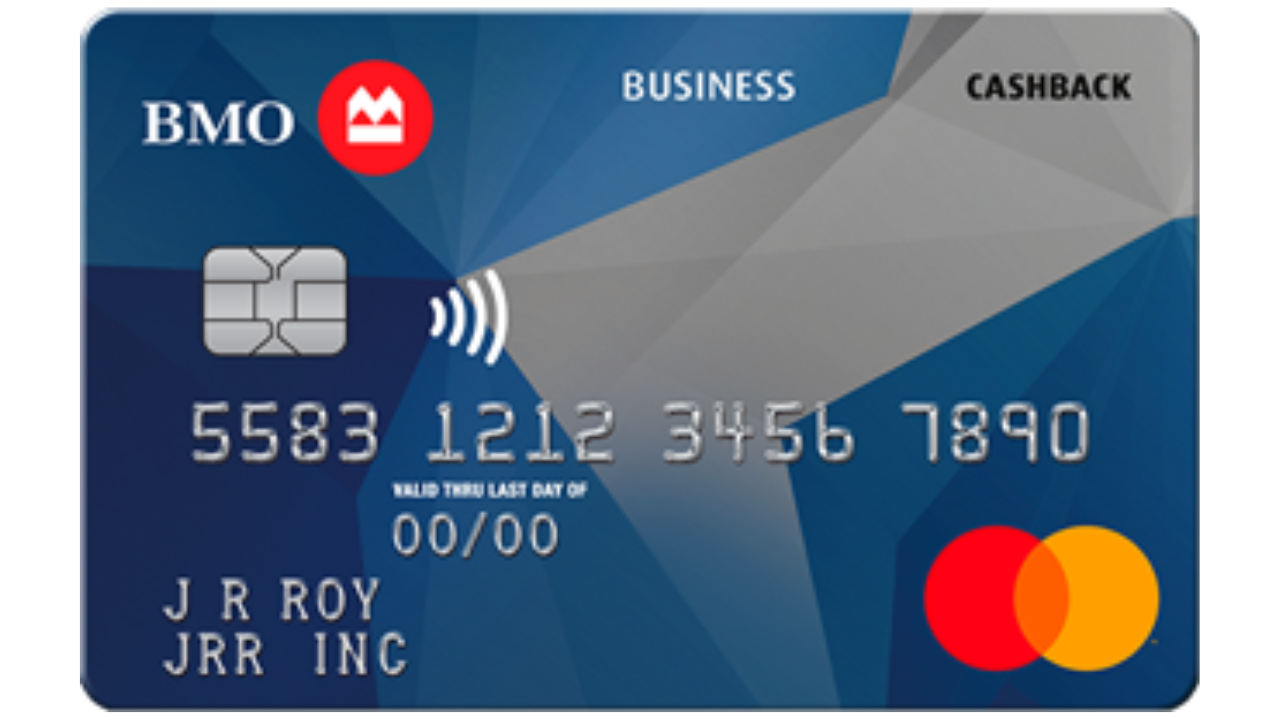

Receive incredible cashback rewards on all your business expenses!

BMO CashBack Business – Earn cashback on every purchase without any annual fees.

Advertisement

The BMO CashBack Business Mastercard credit card comes with an attractive welcome bonus and a bundle of rewards, all while waiving annual fees to reduce your business costs and increase your earnings. Check out our comprehensive review for further details.

See below for a list of several advantages that come with owning a BMO CashBack Business Mastercard credit card and learn why it is the perfect card for your business expenses.

You will remain in the same website

In order to apply for a BMO CashBack Business Mastercard credit card as a sole proprietor of a business, you will be required to furnish personal identification along with a Trade Name registration and a Master Business license.

New cardholders can receive a 10% cashback offer on gas, office supplies, as well as cellphone and internet bill payments for a duration of three months starting from the time of account opening.

The BMO CashBack Business Mastercard credit card has no annual fee, with the only mentioned charges being a 19.99% interest rate for purchases and 22.99% for cash advances.

Upon receiving your BMO CashBack Business Mastercard credit card in the mail, you must visit the cashback website to register your credit card. Afterwards, you can choose your preferred method of redeeming your cashback rewards.

Here’s a rundown of the pros and cons of using the BMO CashBack Business Mastercard:

Benefits and advantages:

- No Annual Fee: Enjoy cash back rewards without pesky annual fees eating into your earnings!

- Awesome Welcome Offer: Score big with 10% cash back on gas, office supplies, and phone/internet bills for the first 3 months. Talk about a sweet deal to kickstart your savings!

- Cash Back Galore: Earn up to 1.75% cash back at Shell and 1.5% on other everyday business expenses. It’s like getting rewarded for things you’re already buying!

- Flexibility in Rewards: Redeem your cash back easily, giving you the freedom to use your earnings however you like.

- Perks for Business Owners: Get up to 22 additional cards for your team and safeguard against employee card misuse with the Liability Waiver Program. Business management made easy!

- Introductory Balance Transfer Offer: Move balances over with a 0.00% intro rate for 9 months! Just keep in mind the 3% transfer fee.

- Accepted Everywhere: With Mastercard backing you up, you can swipe (or tap) with confidence at millions of locations worldwide.

Possisble disadvantages:

- Watch Out for High Interest: The interest rates on purchases and cash advances are a bit steep, so aim to pay your balance in full each month to avoid extra charges.

- Transfer Fee Alert: While the intro balance transfer rate is tempting, remember the 3% transfer fee when crunching the numbers.

- Welcome Offer Limits: The 10% cash back offer is only for specific categories and lasts for 3 months. Be sure to maximize your rewards during this time!

- Limited Cash Back Categories: Not all purchases earn high cash back rates, so keep an eye on which expenses are racking up the rewards.

- Employee Card Risks: While the Liability Waiver Program helps, issuing multiple cards to employees still carries some risk of misuse.

The BMO CashBack Business Mastercard Credit Card offers a lot of benefits for you and your business. The application for the card is easy and simple.

Learn more about how to apply and the steps required to get the BMO card by clicking the link below.

Apply for BMO CashBack Business Mastercard

With a BMO CashBack Business Mastercard credit card, you can receive cashback on all your purchases. If you're interested in applying for this card, check the link below!

However, if you’re looking for a personal credit card we have another recommendation for you.

Take a look at the Petal® 1 Visa® Credit Card. The card offers cashback rewards and no annual fee! It’s simple to apply and you have good odds of approval.

Click the link below to learn more about it.

Petal® 1 “No Annual Fee” Visa® Credit Card

Petal® 1 "No Annual Fee" Visa® Credit Card is designed for all, regardless of your credit history. It considers other factors besides credit score to decide eligibility.

Trending Topics

LendingPoint Personal Loan Review: Flexibility for your finances!

Explore LendingPoint's flexible personal loan options: loan amounts from $2,000 to $36,500. Discover if it's the right fit for your needs.

Keep Reading

Discover Personal Loan Review: Quick and Convenient

Discover personal loans offer competitive APRs and loan amounts up to $35,000. Learn more about their features and eligibility criteria in our review.

Keep Reading

Avant Personal Loan Review: Friendly Financing Options

Learn how Avant personal loan provide fast funding for individuals with fair credit. Discover rates, terms, and eligibility in our review.

Keep ReadingYou may also like

UNITY Visa® Secured Credit Card Review: Say Hello To Credit

A new and secure financial path with the UNITY Visa® Secured Credit Card. See what's essential when you apply!

Keep Reading

BMO CashBack Business Mastercard: CashBack

Discover the BMO CashBack Business Mastercard and maximize your business rewards with no annual fee. Learn how to apply now!

Keep Reading