Credit Card

Sable Debit Card: Cashback

Are you tired of strugling just to open a simple bank account? If so, Sable have taken notice of your frustration and have devised a solution. Keep reading to discover the numerous benefits of using a Sable debit card.

Advertisement

Note: the Sable debit card is no longer available.This review remains on our blog for educational purposes, providing information about the card’s features and benefits as they were when the card was active.

The Sable debit card is a cashback reward card that doesn’t charge any fees

Obtaining a Sable debit card has the potential to revolutionize your interactions with financial institutions.

Such environments can be daunting, particularly for non-U.S. citizens struggling with financial difficulties.

Bureaucratic red tape can hinder access to essential financial services, preventing one from achieving financial stability.

The creators of Sable recognized this issue and aim to provide a welcoming environment for individuals from all walks of life to access checking accounts, debit cards, and even credit cards to manage their finances and achieve economic prosperity.

Sable’s approach empowers individuals and allows them to maintain their dignity while securing a prosperous financial future.

With Sable, you can enjoy fee-free transactions and top-notch customer service available in multiple languages.

Moreover, the accompanying app assists you in monitoring your expenses and taking control of your finances. This revolutionary financial service is definitely worth exploring, so continue reading to find out more.

Capital One Walmart Rewards® Mastercard®

Discover how to apply for the Capital One Walmart Rewards® Mastercard® and begin earning rewards on all your purchases!

No credit score is required

No fees

Unlimited and no fees

No welcome bonus

1% cashback

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Is the Sable debit card legitimate?

The Sable debit card is not only legitimate but also ethical. It was created by immigrants who experienced difficulties in gaining acceptance from traditional financial institutions.

Sable has a unique approach to banking and believes that everyone deserves exceptional financial services to manage their money effectively.

Effective financial management can make or break a person’s ability to achieve their goals.

Sable offers fee-free accounts that do not require a credit score or Social Security Number, ensuring accessibility for all.

You can withdraw cash from ATMs or make online purchases using a virtual card. Additionally, the Sable Mastercard provides benefits and guarantees broad acceptance for your debit card.

Is getting a Sable debit card worth it?

Managing money becomes complicated when relying solely on cash stored at home.

Therefore, having a checking or savings account is essential. If you’re searching for a modern financial institution to trust with your money and provide you with a debit card, consider opening a Sable account.

Pros

Sable debit card offers:

- Inclusivity for people of all nationalities, regardless of US citizenship or Social Security Number;

- Efficient and modern account management app;

- No fees or minimum deposit requirements;

- Doubled extended warranty on selected purchases;

- Purchase protection;

- Competitive international money transfer rates;

- Instant virtual card for digital wallet use while waiting for physical card.

Cons

While using this card won’t help build credit history, Sable provides the option to apply for a secured credit card.

Credit score required

Sable bank doesn’t mandate a credit score for opening an account. It aims to assist individuals without credit scores in accessing banking services such as checking and savings accounts, debit cards, and even secured credit cards for credit-building purposes.

How to apply for a Sable debit card?

Getting a Sable debit card is easy and straightforward, just like the rest of the account.

Your application will be meticulously evaluated, not solely for your creditworthiness, but for your entire circumstances. Read on for a step-by-step guide.

Apply online

Managing your Sable account is made easy with the intelligent features of their mobile app.

You can access all the information you need about your expenses and benefits right from your smartphone.

To get started with your Sable card, simply visit their website and complete the registration process by filling out a short form with your personal information including your full name, email address, and a password.

After completing the initial registration, you can proceed with your Sable card application by downloading the app for free from Google Play Store or Apple Store.

Next, you will need to provide some additional personal information such as your social security number or passport details and address.

Once you have completed the registration process, you will receive a virtual card that you can use immediately after depositing any amount into your account.

How about a credit card with cashback rewards?

How about exploring credit cards with cashback rewards? If you’re already enjoying the 1% cashback from your Sable debit card, you might be interested in getting even more cashback.

Check out our Capital One Walmart Rewards® Mastercard® review to see if this credit card suits you best. Keep reading to discover more.

Capital One Walmart Rewards® Mastercard®

Discover how to apply for the Capital One Walmart Rewards® Mastercard® and begin earning rewards on all your purchases!

Trending Topics

Upgrade Personal Loan Review: Flexible Terms, Fast Funding

Learn if the Upgrade personal loan with rates as low as 8.49% is right for you. Check the full review and the link to apply online!

Keep Reading

Amazon Prime Rewards credit card: Earn While You Shop

Learn how the Amazon Prime Rewards Credit Card can help you earn cashback on every purchase. Discover the exclusive benefits now.

Keep ReadingYou may also like

UNITY Visa® Secured Credit Card Review: Say Hello To Credit

A new and secure financial path with the UNITY Visa® Secured Credit Card. See what's essential when you apply!

Keep Reading

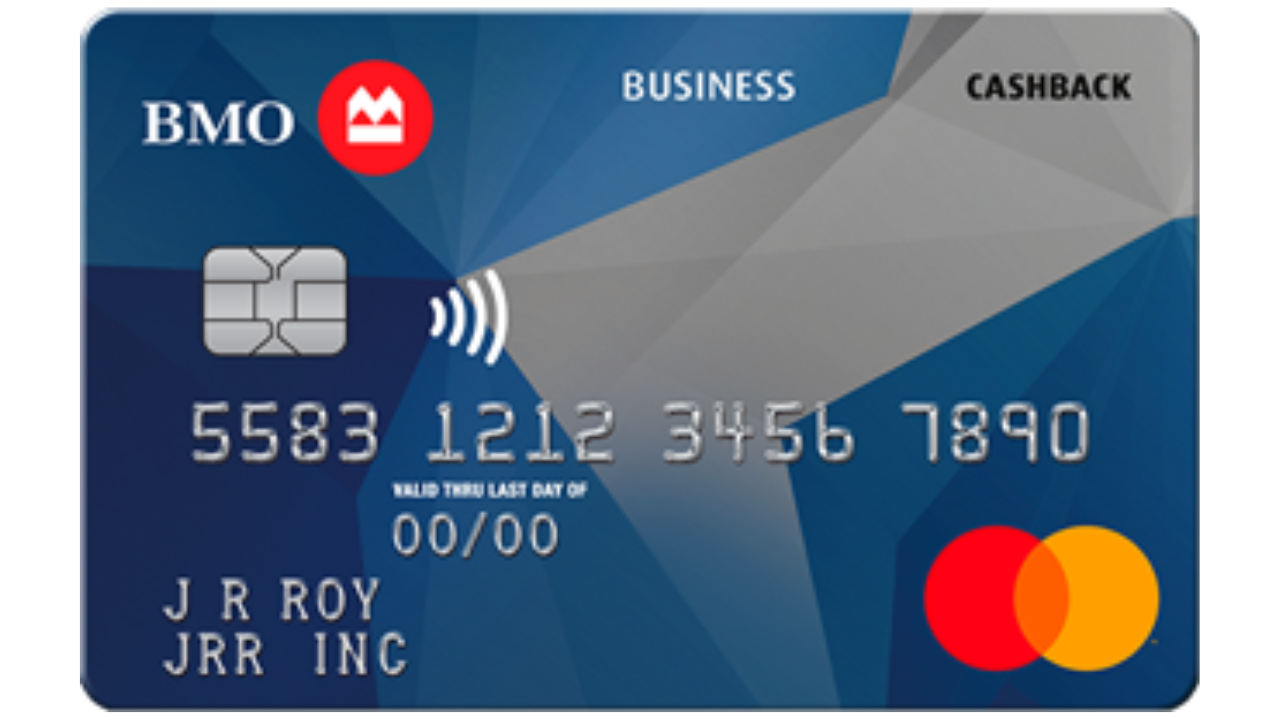

BMO CashBack Business Mastercard: CashBack

Discover the BMO CashBack Business Mastercard and maximize your business rewards with no annual fee. Learn how to apply now!

Keep Reading