Wonderful! I have just discovered the ideal card for you!

The Sable card: a card that suits – and rewards – everyone!

Advertisement

Accessing basic financial services such as a checking account or a debit card can be more challenging for individuals who do not hold U.S. citizenship. However, managing finances efficiently is a right that everyone should have. With Sable, you can obtain a Sable debit card without the need for a credit score. Simply open your account online and download the mobile app to start using your card at all locations.

Accessing basic financial services such as a checking account or a debit card can be more challenging for individuals who do not hold U.S. citizenship. However, managing finances efficiently is a right that everyone should have. With Sable, you can obtain a Sable debit card without the need for a credit score. Simply open your account online and download the mobile app to start using your card at all locations.

You will remain in the same website

This exceptional debit card provides numerous benefits for you:

You will remain in the same website

Certainly! Upon approval for the Sable Debit Card, you can receive limitless cashback on qualifying brands, along with access to Purchase Protection and various other benefits. Moreover, there are no annual fees or minimum deposit requirements associated with this card.

With the Sable debit card, you can earn limitless 1% cashback rewards on purchases made at popular retailers like Amazon.com, Spotify, Netflix, Uber, Uber Eats, Hulu, Whole Foods Market, and many others! This means that you can receive cashback on everyday purchases and earn unlimited rewards.

To load your Sable debit card, you can visit any of the participating stores, which include CVS, Walmart, RiteAid, Walgreens, Safeway, Dollar Tree, Dollar General, and Kroger. However, not all merchants offer Sable for free, and there is a daily limit of $500 for loading funds onto the card. To add money, present your card to the cashier at the register. Please note that at present, the virtual card cannot receive cash deposits.

Navigating the complexities of financial management as an immigrant or international citizen in the United States can be daunting.

That’s where the Sable Debit Card comes in, offering a tailored solution to help you take control of your finances and achieve your goals.

Let’s explore the key features and benefits of this innovative financial tool.

Pros:

- No-Fee International Transactions: Say goodbye to hefty foreign transaction fees when traveling or sending money abroad. With the Sable Debit Card, you can make purchases and ATM withdrawals internationally without worrying about additional charges.

- Early Paycheck Access: Gain access to your paycheck up to two days earlier with direct deposit, giving you greater flexibility and control over your finances.

- Credit Building Tools: Build your credit history from scratch or improve your existing credit score with Sable’s credit-building features. By using your Sable Debit Card responsibly, you can establish a positive credit profile over time.

- Financial Education Resources: Access to educational resources and tools to help you better understand and manage your finances, empowering you to make informed decisions and achieve financial wellness.

- Easy account setup: No Social Security number was required to open an account, making it attractive to newcomers to the US.

- Cashback rewards: You earned 1% cashback on most debit card purchases.

Cons:

- Limited features: Compared to other debit cards, Sable offered a basic checking account with no interest-bearing accounts or advanced features.

- Lower cashback rewards: The 1% cashback rate might be less attractive than some other debit card reward programs.

- No contactless payment: The card might not have supported contactless payment options like Apple Pay or Google Pay.

With features like no-fee international transactions, early paycheck access, and credit-building tools, it offers a holistic approach to financial management.

While it may have some limitations, its focus on empowering users with financial education and resources sets it apart as a promising option.

How to apply for Sable Card?

Get a Sable card for free by opening an account online. This article will guide you on the application process.

Consider the Walmart debit card as an alternative option for purchasing at your preferred retailers.

This card lets you earn cashback rewards and waive the annual fee by setting up direct deposits. Check out our post below for more information on how to apply and obtain this fantastic card.

Applying for Capital One Walmart Rewards – How to?

Learn how to apply for the Capital One Walmart Rewards® Mastercard® and start earning rewards on every purchase!

Trending Topics

Oportun Personal Loan Insights: Accessible Loans!

Fast approval and flexible terms make Oportun personal loan stand out. Read our review to learn about the pros and cons of Oportun loans.

Keep ReadingYou may also like

Chase Freedom Unlimited®: Cash back with a great welcome bonus

Maximize your rewards with the Chase Freedom Unlimited Credit Card: 0% introductory APR, $0 annual fee, and generous cashback.

Keep Reading

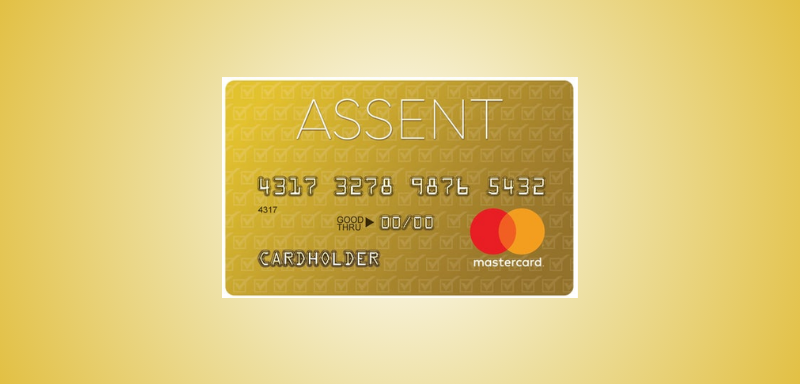

Assent Platinum Secured Mastercard Review: Security Meets Rewards

Take a close look at the Assent Platinum Secured Mastercard—your key to rebuilding credit with a 0% intro APR!

Keep Reading