Loans

LoanNow Personal Loans review: Fast Cash Without the Fuss

Needing a quick cash injection? LoanNow offers short-term loan solutions. But is it the answer to your financial woes? Our review delves into the details.

Advertisement

Is LoanNow Legit? Exploring the Pros, Cons, and Rates of Short-Term Loans

When you’re looking for a fast, convenient solution for personal loans, LoanNow might just be your best bet.

Unlike traditional banks that make you wade through piles of paperwork and wait weeks for a decision, LoanNow streamlines the process, so you get what you need without the fuss.

LoanNow offers reassuring confidentiality for all your sensitive financial and personal information, ensuring it remains secure.

No need to worry about sharing your financial history with third parties or dealing with payday loans’ sky-high interest rates. It’s a refreshing change in the world of personal finance, tailored to meet your urgent funding needs efficiently.

Ready to find out more about how LoanNow can make your life easier? Dive into the rest of this article for all the essential details and see how you can benefit from their simple, speedy loan application process.

Decoding LoanNow Personal Loan: Key Features

LoanNow Personal Loan offers a smart solution for those seeking financial assistance. Whether you need funds for an emergency or a significant purchase, LoanNow has got your back.

Key Features:

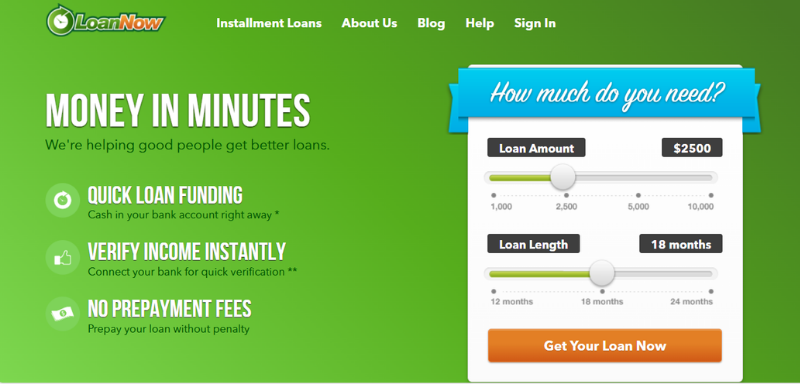

- Loan Amounts: You can borrow between $1,000 to $10,000. This range provides flexibility to meet different financial needs.

- Repayment Terms: Choose terms ranging from 12 to 24 months. This means you can find a plan that fits your budget.

- Interest Rates: Competitive interest rates are a standout feature. This makes repayments more manageable.

Unique Perks:

- Quick Process: With a fast and easy online application, you won’t be left waiting for weeks.

- No Hidden Fees: Transparency is a priority. There are no surprise fees.

- Credit-Building Opportunity: Timely repayments can improve your credit score.

Reliability:

LoanNow is recognized for its trustworthy services. Their straightforward terms and dedication to customer service make them a reliable lender.

Value Proposition:

LoanNow combines flexibility, competitive rates, and reliability, offering a solid personal loan option. Make informed decisions with confidence and find the financial support you need.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros and cons: Is this loan a fit for you?

LoanNow Personal Loans come with a mix of advantages and disadvantages. By looking closely at both, you can decide if this loan type matches your needs.

The highs…

- Interest rates for fast cash solutions: Compared to credit cards, LoanNow often offers lower interest rates, saving you money over time.

- Quick access to funds: Need money fast? LoanNow provides quick approval and access to your loan amount.

- Flexible usage: Use the loan for almost anything – debt consolidation, home improvement, or unexpected expenses.

- Fixed monthly payments: Predictable payments help you budget better and avoid surprises.

- No prepayment penalties: Pay off your loan early without any extra fees, which can save you on interest.

… and the lows:

- Potential fees: Watch out for origination fees and late payment penalties that can add up.

- Credit impact: Taking out a loan affects your credit score, especially if you miss payments.

- Higher rates for lower credit scores: If your credit isn’t great, you might face higher interest rates compared to other options.

- Borrowing limits: There’s a cap on how much you can borrow, which might not meet your needs if you require a large amount of money.

Eligibility requirements check-list to apply for the LoanNow Personal Loan

To score a LoanNow Personal Loan, you need to tick off some key boxes. Here’s your handy checklist:

- Credit Score: Aim for a score of at least 600. The higher, the better, but don’t worry—LoanNow considers more than just numbers.

- Income: Steady income is crucial. LoanNow may require proof of employment or a regular income stream. They want to ensure you can repay the loan.

- Debt-to-Income Ratio: Keep this under 40%. This means your total monthly debt payments shouldn’t exceed 40% of your monthly income.

- Employment Status: Be prepared to show stability. Full-time, part-time, or even self-employment works, as long as it’s steady.

- Citizenship: You must be a U.S. citizen or permanent resident. Proper documentation is essential.

- Age: You need to be at least 18 years old.

- Identification: Valid ID is a must. Think driver’s license, state ID, or passport.

Tips to improve your chances of getting Loan Approval:

- Clean Up Your Credit Report: Before applying for any loan, request a free copy of your credit report from each major credit bureau (Experian, Equifax, TransUnion). Double-check for any errors that could be bringing down your score. If you find mistakes, dispute them immediately to ensure your credit report accurately reflects your financial health.

- Boost Your Income Power: A steady and sufficient income is crucial for loan approval. Consider exploring side hustle opportunities to supplement your income and demonstrate a stronger financial standing to potential lenders.

- Tackle Existing Debt: High debt-to-income ratio (DTI) can be a red flag for lenders. Focus on paying down smaller debts first to improve your DTI and showcase your ability to manage credit responsibly. This can significantly increase your chances of loan approval.

With these requirements in mind, you’ll be better equipped to grab that LoanNow Personal Loan and use it for your big plans, whatever they may be. Good luck!

Treasure’s roadmap: How to apply for this loan

LoanNow prides itself on a streamlined application process. They typically require basic information like your income and employment details.

Approval can be quick, potentially within minutes, and funding might be available as soon as the next business day. Let’s see how it works, step-by-step:

Step 1: Prequalification

First things first, you need to prequalify. Visit the LoanNow website and fill out the prequalification form. You’ll need basic information like your name, address, and income.

Make sure you have a credit score in the mid-600 range. This is key to get through the initial screening.

Step 2: Gather Your Documents

Get your paperwork ready! Gather documents like:

- Proof of income (pay stubs or tax returns)

- Identification (driver’s license or passport)

- Bank statements

Make sure everything is up-to-date.

Step 3: The Application

Now you’re ready to apply. Log in to your LoanNow account and start the application process. Here’s what you’ll need to do:

- Fill out the application form: Provide detailed information about your financial situation.

- Upload documents: Use the handy upload feature on the dashboard to submit your documents.

Step 4: Review & Submit

Double-check your application. Ensure all details are accurate. Hit the submit button and let the LoanNow team do their magic!

Step 5: The Waiting Game

LoanNow offers same day processing, so you won’t be left hanging for too long. During this time, your application is reviewed.

Step 6: Review Loan Offers

You’ll receive loan offers if you get approved. Each offer will outline the loan amount, interest rates, and terms. Compare them carefully before making a decision.

Step 7: Accepting the Loan

Once you find a suitable offer, accept it through your dashboard. You may need to sign some additional documents online.

Quick Tips

- Always check for the most recent interest rates.

- Have your documents ready before applying to speed up the process.

- Use the LoanNow support system if you run into any issues.

Good luck! You’re now ready to secure a personal loan through LoanNow.

Step into the Ring: LoanNow Personal Loan versus Rise Credit Loan

Let’s get ready to rumble! In this matchup, we’ll see how LoanNow Personal Loans stack up against Rise Credit Loans. Both contenders offer unique benefits for borrowers, but which one’s the right fit for you? Let’s dive into the details.

Comparison Table

| Metric | LoanNow Personal Loan | Rise Credit Loan |

| Credit Score Requirement | Marginal credit may need cosigners | Varies by applicant |

| APR | Varies but generally higher rates | Ranges from approx. 36% to 299% |

| Loan Amount | $1,00 to $10,000 | $300 to $5,000 |

| Loan Term | 12 to 24 months | 4 to 26 months |

| Fees | Late fee forgiveness | No fees listed but likely varies |

Looking at the table, you can see some clear differences.

Both loans offer opportunities for varying borrower needs. Your choice might come down to the size of the loan and your desired terms.

For a deeper dive into the Rise Credit Loans, make sure to check out our full review. This will help you weigh all factors and find the right loan for you. Happy borrowing!

Rise Personal Loans review

Discover the benefits of the Rise personal loan in our extensive review. Get insights into their terms, fees, and application process.

Trending Topics

Destiny Mastercard® credit card: No security deposit required

Poor Score? Don't Worry! This Destiny Mastercard® credit card review will tell you how to rebuild it. Learn how to apply for this card!

Keep Reading

Premier Bankcard® Card: For bad score

Looking for a credit card to help you build your credit score? Discover the benefits of Premier Bankcard. Take control of your credit!

Keep ReadingYou may also like

Prosper Personal Loans review: Borrow up to $50,000

Prosper Personal Loans Review: Peer-to-peer lending for competitive rates? Explore pros, cons, & if it's right for you.

Keep Reading