Loans

LightStream Personal Loan Review: Low Rates & Fast Funding

Need a loan but unsure if LightStream is a good fit? Our 2024 review analyzes rates, fees, qualifications, and everything you need to know before you borrow.

Advertisement

Get the Cash You Need Without Breaking the Bank: Check LightStream loans!

LightStream personal loans offer a sense of financial flexibility when you find yourself in need of funds for various personal reasons.

Whether you’re looking to consolidate debt, finance a home improvement project, or cover unexpected expenses, a LightStream loan could be a suitable option for you.

With competitive rates, no fees, and a simple online application process, LightStream caters to borrowers with good to excellent credit scores.

These features make LightStream an attractive choice for those who value straightforward terms and a clear repayment plan.

If you’re considering a personal loan and have a credit score of 660 or higher, exploring a LightStream personal loan could be worth your while.

Dive in to see if their offerings align with your financial plans and how you could benefit from a personalized loan.

Decoding LightStream Personal Loan: Key Features

LightStream, known for its personal loans, serves as an attractive option for you if you have a good credit score and require financial assistance.

It’s part of Truist Bank and doesn’t necessitate bank membership, thus broadening accessibility.

Loan Amounts and Terms

- Amounts: Loans range from $5,000 to $100,000, catering to various financial needs, from debt consolidation to home renovations.

- Terms: Flexible repayment terms help align with your budgeting needs.

Interest Rates

- Competitive rates: Interest rates are structured to be competitive, especially for those with excellent credit profiles.

- AutoPay Discount: Opting for automatic payments avails you of reduced rates, contributing to long-term savings.

Funding Speed

- Same-Day Funding: In need of quick funds? LightStream may disburse funds on the same day of application, subject to conditions.

Reliability of Lender

- LightStream’s association with Truist Bank conveys trust and stability, entrusting you with a reliable financial partner. Their emphasis on serving borrowers with strong credit histories enhances their reputation for reliability.

In choosing LightStream, you’re not just selecting a personal loan but rather a comprehensive financial tool backed by a reputable lender.

This can provide you the assurance and help in managing significant expenses with flexibility and peace of mind.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros and cons: is this loan a fit for you?

When considering a LightStream Personal Loan, it’s essential to weigh the advantages and disadvantages carefully. These factors can help determine whether this loan aligns with your financial goals and needs.

The highs…

- Versatile loan options: LightStream loans range from $5,000 to $100,000, adapting to a variety of financial needs.

- Competitive interest rates: Providing low-interest rates for borrowers with good credit.

- No fees: You won’t encounter fees for origination, prepayment, or late payments.

- Quick funding: Some borrowers may receive funds on the same day they apply, under certain conditions.

- Long loan terms: Loan terms are available between two to seven years, offering flexibility.

… and the lows:

- High credit standards: LightStream is best suited for those with good to excellent credit.

- Minimum loan amount: The minimum loan amount of $5,000 may be too high for small, short-term borrowing needs.

- No pre-qualification option: There is no way to check potential rates without a hard credit pull, which can affect your credit score.

- No face-to-face service: As an online service, there’s no option for in-person customer support.

Eligibility Requirements Checklist to Apply for the LightStream Personal Loan

To apply for a LightStream Personal Loan, you’ll need to meet certain eligibility criteria, which can vary based on the purpose of the loan. Below is a checklist to help you determine if you might qualify:

- Minimum Credit Score: Aim for a credit score of at least 660. Keep in mind, the higher your score, the better your chances of approval.

- Credit History: You should have a history of responsible credit use for several years.

- Income: There isn’t a specified minimum income threshold, but having sufficient income to cover existing debts and your new loan payment is essential.

- Debt-to-Income Ratio: A lower debt-to-income ratio is better. Ensure that your total debt isn’t too high compared to your income.

- Employment: Steady employment is critical. Be prepared to prove your employment status and income stability.

- Citizenship: You must be a U.S. citizen or a permanent resident to apply.

- Age: Be at least 18 years old (or the state minimum, if higher).

Before applying, gather your financial documents and check your credit report for any discrepancies.

Remember, pre-approval doesn’t impact your credit score, so it’s a good way to gauge your eligibility.

If you’re uncertain about meeting the qualifications, working on improving your credit score or paying down existing debt could enhance your eligibility.

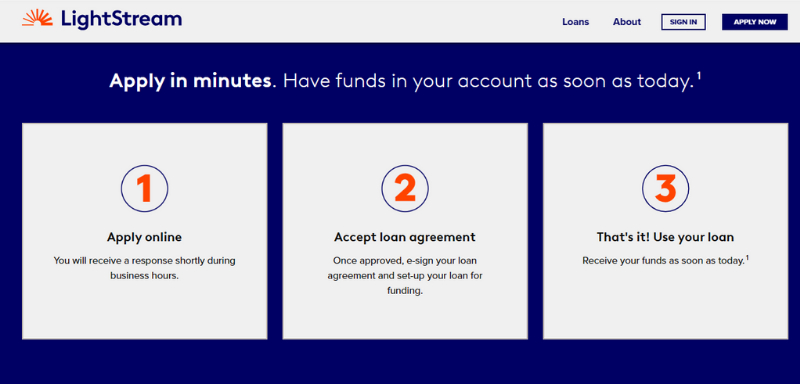

Treasure’s Roadmap: How to Apply for This Loan

Applying for a LightStream Personal Loan is a streamlined process. It’s important that you gather all the required information before you start. Here’s a friendly guide to help you navigate the application steps:

Step 1: Prequalification

- Review Eligibility: Ensure you meet the basic requirements such as age, having a valid Social Security number, and US residency.

- Check Your Credit: Since LightStream caters to applicants with good to excellent credit, it’s wise to review your credit score beforehand.

Step 2: Application Process

- Visit the Website: Start by visiting LightStream’s online application page.

- Fill in Personal Information: You’ll need to provide:

- Full name

- Address details

- Employment information

- Social Security number

- Financial information, including income and expenses

- Loan Details: Specify your loan amount, purpose, and desired term length.

- Submit Documentation: Accurately upload or prepare to submit necessary financial documentation, if requested.

Step 3: Loan Approval Review

- Await Response: After submitting your application, LightStream will evaluate your creditworthiness and loan request. This process is typically quick.

- Review Offers: If approved, you will receive loan options. Review them carefully, focusing on APR, term, and monthly payments.

Step 4: Acceptance Procedure

- E-sign Documents: Once you choose your preferred loan offer, you’ll e-sign the agreement.

- Receive Funds: Upon completing the e-signature process, you can expect to receive the funds directly into your account, based on the disbursement schedule you agreed upon.

Remember, taking time to provide accurate information can help smooth your application process. Good luck!

Step into the ring: LightStream Personal Loan versus SoFi Personal Loan

When considering a personal loan, you may find yourself comparing LightStream and SoFi, two popular financing options. Both offer unique benefits that could cater to your specific financial needs.

Here’s a simple table to break down the essential aspects of each, helping you discern which might be the better fit for you:

| Feature | LightStream | SoFi |

| Credit Score Required | Typically 660+ | Typically 680+ |

| APR Range | 4.49% – 20.49% | 5.74% – 20.28% |

| Loan Amounts | $5,000 – $100,000 | Varies |

| Terms | 2 to 12 years | Up to 7 years |

| Fees | No fees; 0.5% autopay discount | No fees; 0.25% autopay discount |

LightStream shines with its potentially lower APRs and longer repayment terms, which could ease your monthly budgeting.

The absence of fees and rate discounts for autopay make it a cost-effective choice. On the flip side, LightStream’s higher credit score requirement might be a barrier for some.

SoFi, while having a slightly higher starting APR, often serves as a robust competitor with borrower-friendly features, including an easier application process for some and career support options.

However, the shorter maximum loan term could lead to higher monthly payments.

To identify which loan aligns with your financial goals, consider your credit health, how much funding you need, and how quickly you can repay the loan.

Eager for more details on SoFi Personal Loans? They deserve a closer look to assess if they’re the right financial partner for you.

SoFi Personal Loan Review: Low rates, big impact!

Considering a personal loan? Dive into our SoFi review to uncover its features, eligibility requirements, and pros and cons!

Trending Topics

Premier Bankcard® Card: For bad score

Looking for a credit card to help you build your credit score? Discover the benefits of Premier Bankcard. Take control of your credit!

Keep Reading

LoanNow Personal Loans review: Fast Cash Without the Fuss

LoanNow: Fast cash or financial trap? This Review unveils pros, cons, & rates for LoanNow personal loans: See if it's worth it!

Keep ReadingYou may also like

U.S. Bank Altitude® Go Secured Visa® Card Review: Go further!

A tool like the U.S. Bank Altitude® Go Secured Visa® Card will surprise you with its benefits that go beyond the obvious

Keep Reading

Reflex® Platinum Mastercard® Review: Making Credit Access Easier

Apply for the Reflex® Platinum Mastercard® and discover the benefits of effectively rebuilding your credit! Check the full review.

Keep Reading