Loans

Achieve Personal Loan review: Fast Funding for Your Big Plans

Achieve personal loans offer a range of benefits tailored to modern borrowers. Read our detailed review to find out how they can help you reach your financial goals with ease and confidence.

Advertisement

Why Achieve Personal Loans Stand Out in the Crowd

Navigating the world of personal finance can sometimes feel like trying to solve a Rubik’s Cube blindfolded. But every now and then, a service like Achieve Personal Loan swings by, offering a glimmer of hope to those juggling debt and financial goals.

They’re all about personal loans, debt consolidation, and doling out financial wisdom like a wise old money sage.

With Achieve, gone are the days of fearing a glance at your credit report. They welcome applications from a diverse credit landscape, for loans ranging from the humble $1,000 to a more princely sum of $15,000.

Imagine what you could do with that – pay off bills, consolidate debt, or maybe stage a miniature Broadway musical in your backyard (hey, dreams can be diverse too).

So, dust off that financial to-do list and consider adding ‘Check out Achieve’ right between ‘Cancel unused gym membership’ and ‘Learn to cook that quinoa thing.’

If sorting out your debt and simplifying your life sounds as appealing as a hot slice of pizza on a cold day, Achieve’s friendly suite of services might just be worth your perusal.

Who knows, you could be one quick application away from a less cluttered financial future. Ready to see if they can help you hit your high notes? Take a deep breath, and let’s dive in!

Decoding Achieve Personal Loan: Key Features

When the purse strings are tight, and you’re eyeballing a financial goal that’s just out of reach, an Achieve personal loan might just be the boost you need.

Think of it as your financial Swiss Army knife—versatile and ready to help you slice through your debt or expand your budget for significant expenses.

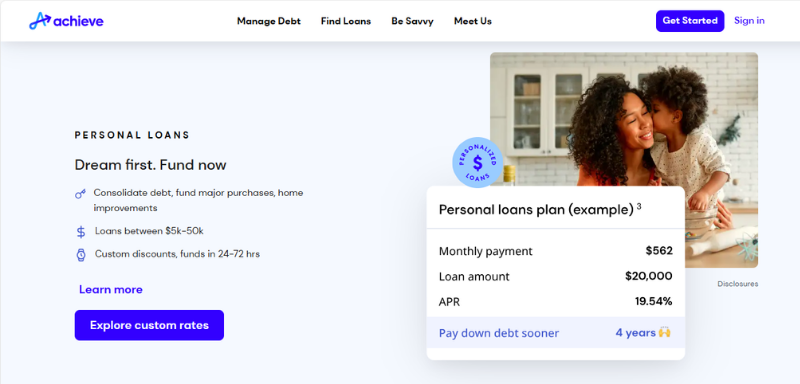

- Loan Amounts: You can secure a loan ranging from $5,000 to $50,000. Whether it’s for sprucing up your home, consolidating debt, or covering unexpected costs, there’s room to maneuver.

- Credit Score Flexibility: Got a credit score of 620 or higher? You’re in the game. Achieve caters to a wide audience, so don’t shy away if your financial history isn’t spotless.

- Quick Funding: In a rush? They’re known for fast turnarounds, which can be a real lifesaver when you need funds in a flash.

Here’s a quick rundown of what you’re looking at:

| Repayment Terms | Flexible, giving you breathing space |

| Interest Rates | Fixed, so no surprises on monthly payments |

| Prequalification | Possible without harming your credit score |

You’ve got extra perks like tech that minimizes the paperwork hassle and dedicated consultants to guide you through the maze of borrowing.

Worried about fees playing hide and seek? Not an issue—hidden fees aren’t part of the deal.

Reliability? Achieve, through trusted partners like Cross River Bank and MetaBank, N.A., stands strong. They’ve been in the game since 2013, so they’re not new kids on the financial block.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros and cons: is this loan a fit for you?

Deciding on a personal loan is like picking out a new outfit—you need to make sure it fits you well.

Achieve Personal Loans might look enticing on the rack with their flexible uses and potential for debt consolidation, but like any garment, you’ll want to check the seams and material to ensure they’re the right choice.

The highs…:

- Broad Loan Range: Borrow between $5,000 and $50,000 to tailor your loan to your financial needs.

- Simplified Debt Consolidation: Consolidate high-interest debt into a single, potentially lower-interest loan.

- Extended Service Hours: Get support from loan consultants when you need it, with service hours into the evening.

- Quick Funding: Upon approval, funds can be swiftly disbursed, often as soon as the next business day.

… and the lows:

- Credit Score Requirements: Might not suit those with a credit history that’s less than fair or good.

- Potentially High APRs: Depending on your creditworthiness, you could face higher annual percentage rates (APRs).

- Extra Fees: Stay alert for origination fees, late fees, or penalties that add to the cost of borrowing.

- Impact on Credit Score: Just like a late library book, missed payments will hurt your credit score, and lenders report your activity.

Eligibility Requirements Checklist to Apply for the Achieve Personal Loan

Before you dash off to snag that personal loan from Achieve, let’s make sure you tick all the necessary boxes.

This isn’t your grandma’s secret cookie recipe; it’s a clear-cut checklist that could lead you to the cash.

- Credit Score Charm: Your credit score should look more like a high-five than a facepalm. We’re not expecting perfection, but having at least a fair to good credit score puts you in the cheering section.

- Stable Income Stream: Got a job? Fantastic. Make sure you can prove you’ve got a consistent stream of income that flows like your favorite playlist – uninterrupted and enough to keep you grooving (or in this case, paying back the loan).

- Debt-to-Income Ratio Dance: Your debts and income should tango at a healthy ratio. Lenders like Achieve often eyeball your financial flexibility, so aim for a debt-to-income ratio that doesn’t make you look like you’re financially doing the splits.

- Employment Status Solo: If you’re swinging it solo as your own boss or you’re employed by The Man, either way, verifiable employment is key to nailing the loan process.

- Citizenship or Residency Routine: Are you a local resident, or do you pledge allegiance to the Stars and Stripes? Essential info, because Achieve is about as American as apple pie and they’ll want to know if you’re one of the crew.

Treasure’s Roadmap: How to Apply for This Loan

Embarking on the quest for an Achieve personal loan, are we? Fear not, your handy map is right here. Follow these steps, and you’ll navigate this treasure hunt like a pro.

Check Your Credit Landscape

Before you start, know your credit score. This gives you an idea of where you stand in the lender’s eyes.

Grab a free credit report at annualcreditreport.com. No treasure map should lack a compass, right?

Prequalify for a Glimpse of the Spoils

Prequalify online, which is a quick peek into what you might get without dinging your credit score.

You’ll need to provide your basic info: your name, address, income, and the desired loan amount.

Documentation: Your Trusty Tools

Prepare your documents. Like every good treasure seeker knows, the right tools ensure success.

Gather your identification, proof of income, and employment details.

Complete the Application

Time for the full application. Here’s where you lay out your grand plan.

Provide all details requested accurately. Any discrepancies might lead you to a booby trap.

Review Your Offers

If you’re approved, review the loan offers. Weigh your options like a wise old sage.

Look at the interest rates, terms, and fees. No one likes a cursed treasure.

Accept Your Treasure

Found the right loan? Click accept, and you’re ready to sign on the dotted line.

Digital signatures can be used. So, no need for a quill and ink.

Now, you’re set to conquer this journey! Remember, patience and attention to detail are your trusty sidekicks on this adventure. Ready, set, go apply! 🗺✨

Step into the ring: Achieve versus Best Egg

When you’re scouting for a personal loan, you might feel like you’re sizing up contenders before a big bout.

In one corner, we have Achieve Personal Loans, flexing its muscles with accessibility for those not sporting the shiniest credit scores.

In the opposing corner? Best Egg, ready to crack the competition with its competitive terms. Let’s peep at the stats:

| Factors | Achieve Personal Loans | Best Egg |

| Credit Score Minimum | 620 | 640 |

| APR Range | 8.99% – 35.99% | Differs, context-specific |

| Loan Amounts | $5,000 – $50,000 | Context-specific, but competitive |

| Loan Terms | Specific terms not listed; investigation needed | Similar approach needed |

| Fees | Prepayment fees may apply | Context-specific |

So, where do they flex the hardest? Achieve Personal Loans seemingly extends a friendly fist bump to those of you with credit scores dancing around 620.

They’ll potentially hook you up when others won’t. If you’re planning a debt consolidation TKO, Achieve could lower your interest rate for good behavior—like using a chunk of your loan to pay off existing debts.

Now, Best Egg isn’t exactly a featherweight. If your credit score’s been doing some heavy lifting and has pushed past that 640 mark, they might entice you with some attractive terms you’ll want to scrutinize.

You’ll want to weigh these contenders based on your personal finance fitness. Got a taste for details?

Then don’t just settle for the ringside seats—jump in and explore a full Best Egg Personal Loans review for all the nitty-gritty. Your perfect financial match awaits!

Best Egg Personal Loan Reviews

Get the scoop on Best Egg personal loans in our comprehensive review. Learn about their low rates, fast funding, and customer-friendly terms.

Trending Topics

BMO CashBack Business Mastercard: CashBack

Discover the BMO CashBack Business Mastercard and maximize your business rewards with no annual fee. Learn how to apply now!

Keep Reading

Upgrade Personal Loan Review: Flexible Terms, Fast Funding

Learn if the Upgrade personal loan with rates as low as 8.49% is right for you. Check the full review and the link to apply online!

Keep Reading

Choose the perfect 0% APR credit card that suits your needs: top choices for you!

Having a credit card with an intro APR can help you save some precious money. To find the best credit card for your needs, check this content!

Keep ReadingYou may also like

OppLoans Personal Loan review: Up to $4,000!

Sail through financial uncertainty with OppLoans! Find out about quick funding, flexible terms, and transparent fees in our review.

Keep Reading